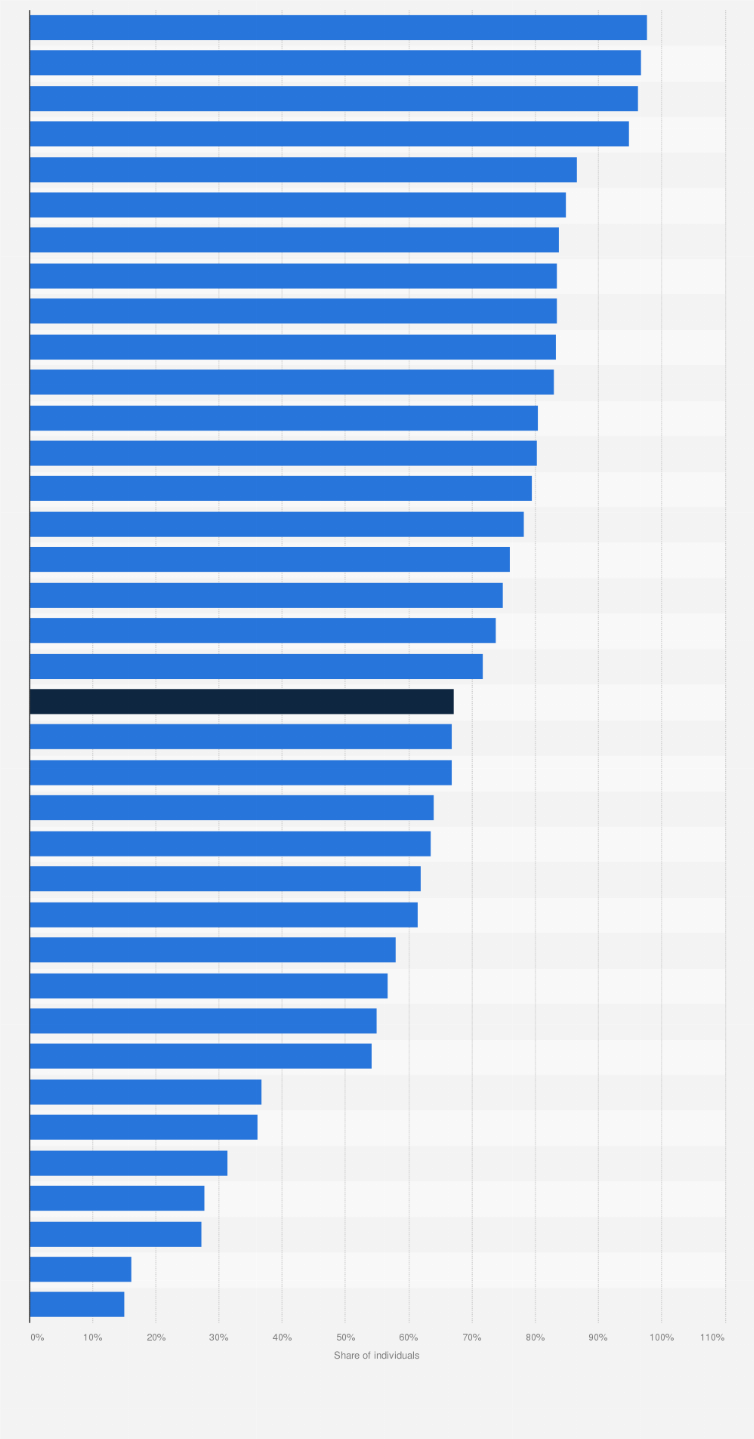

Online banking penetration in Europe 2024, by country

Digital banking adoption has reached remarkable levels across Europe, with the Nordic region leading this transformation in 2024.

Log in or register to access precise data.

Log in or register to access precise data.

Log in or register to access precise data.

Log in or register to access precise data.

Log in or register to access precise data.

Log in or register to access precise data.

Digital banks on the rise

The emergence of digital banks has marked a significant shift in the banking landscape, with these institutions rapidly gaining momentum worldwide. Some of the largest digital banks in the world now boast over 100 million users, showcasing the widespread adoption of digital banking services. Particularly in Europe, leading digital banks like Revolut have experienced exponential growth in recent years, rapidly expanding their customer bases. The UK-based neobank has been on a trajectory of rapid expansion, reaching

Log in or register to access precise data.

Attitude toward digital banks in the U.S.

Opinions on digital banks in the U.S. vary widely within the banking industry, with a growing number of bank executives viewing them as a significant threat to traditional banking models. The rapid rise of digital banks has prompted concerns about market disruption and competition, as these agile fintech players offer innovative solutions and attract a sizable customer base. In the U.S., awareness, popularity, and usage of leading neobanking and neobrokerage apps have steadily increased, underscoring the shifting preferences of consumers towards digital financial services. As digital banks continue to gain traction and reshape the industry landscape, traditional financial institutions are facing pressure to adapt and innovate to remain competitive in the evolving market.