|

Headlines |

Feb-22 |

Jan-22 |

|

Monthly Index* |

523.4 |

514.5 |

|

Monthly Change* |

1.7% |

0.8% |

|

Annual Change |

12.6% |

11.2% |

|

Average Price (not seasonally adjusted) |

£260,230 |

£255,556 |

* Seasonally adjusted figure (note that monthly % changes are revised when seasonal adjustment factors are re-estimated)

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

“Annual house price growth accelerated to 12.6% in February, up from 11.2% in January and the strongest pace since June last year. Prices rose by 1.7% month-on-month, after taking account of seasonal effects, the seventh consecutive monthly increase.

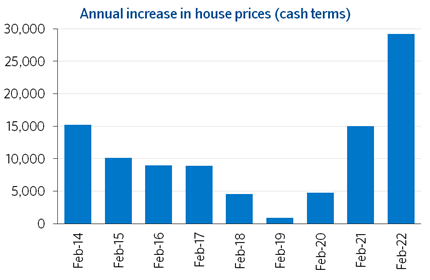

“The price of a typical home rose above £260,000 for the first time in February, an increase of £29,162 over the past 12 months. This is the largest ever annual increase in cash terms since the start of our monthly index in 1991. The price of a typical home is now £44,138 (20%) higher than in February 2020 - the month before the pandemic struck the UK.

“Housing market activity has remained robust in recent months, with mortgage approvals continuing to run above pre-pandemic levels at the start of the year. A combination of robust demand and limited stock of homes on the market has kept upward pressure on prices.

“The continued buoyancy of the housing market is a little surprising, given the mounting pressure on household budgets from rising inflation, which reached a 30-year high of 5.5% in January, and since borrowing costs have started to move up from all-time lows in recent months.

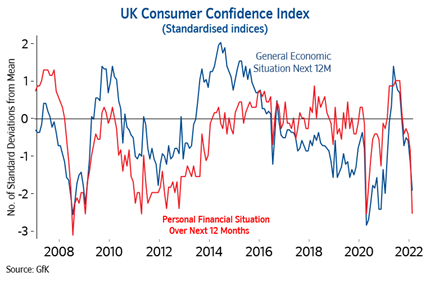

“The strength is particularly noteworthy since the squeeze on household incomes has led to a significant weakening of consumer confidence. Indeed, consumers’ view of the general economic outlook and prospects for their own financial circumstances over the next 12 months have plunged towards levels prevailing at the start of the pandemic, as shown in the chart below.

“The economic outlook is particularly uncertain at present. Nevertheless, it is likely that the housing market will slow in the quarters ahead. The squeeze on household incomes is set to intensify, with inflation expected to rise above 7% in the coming months.

“Indeed, there is scope for inflation to rise even further as events in Ukraine threaten to send global energy prices even higher. Assuming that labour market conditions remain strong, the Bank of England is also likely to raise interest rates, which will exert a further drag on the market if this feeds through to mortgage rates.

“Housing affordability has already become more stretched, in part because house price growth has been outstripping earnings growth by a wide margin since the pandemic struck. The price of a typical home is now equivalent to 6.7 times average earnings, up from 5.8 in 2019.”

-ends-