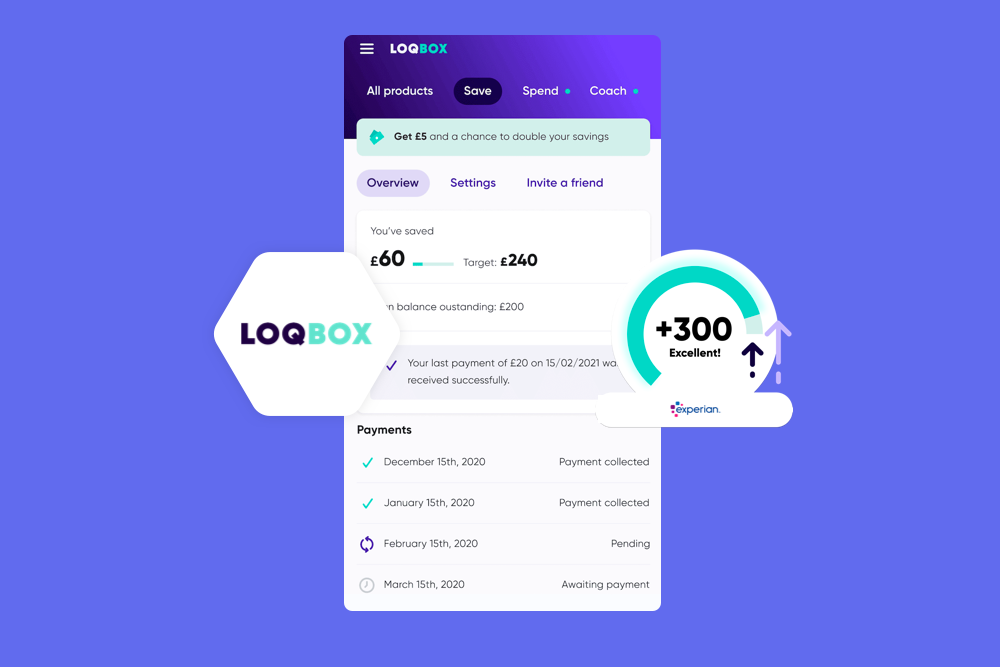

92% of LOQBOX members who currently rent, want to own their own home, according to a recent survey. To help them achieve their goal, LOQBOX has launched a brand new feature, LOQBOX Rent, allowing members to use MoneyHub's open banking technology to track and report rent payment behaviour to Experian. This will help renters to build their creditworthiness, making them more eligible for a mortgage in the future.

Co-founder and Co-CEO of LOQBOX Tom Eyre commented: "Since launching LOQBOX in 2017, we have already helped nearly 1 million people in the UK and the US. Our latest feature is the first of many new developments to the LOQBOX membership suite. We are committed to giving our members access to a richer life. There will be a range of brand new features being launched in what will be a very exciting year for LOQBOX members”.

LOQBOX partnered with Moneyhub and Experian to launch LOQBOX Rent. Open banking allows LOQBOX to accurately identify regular rent payments and report them to Experian.

Jonathan Westley, Chief Data Officer at Experian UK&I, said: "Since the introduction of the Rental Exchange in 2012, we have been working hard to ensure rental payments are recognised in a similar way to mortgages. Our partnership with LOQBOX and Moneyhub is the latest development in this exciting journey.

"By using cutting-edge open banking technology, we are making it easier for more people to seamlessly add rental payment information to their credit report, helping them strengthen their credit history and improve their chances of accessing fair and affordable credit. I’m looking forward to seeing the benefits this partnership can bring.”

LOQBOX Rent was launched using MoneyHub's open banking solution. The open banking solution allows LOQBOX members to have their monthly rent payments identified and subsequently reported to credit reference agency Experian, improving their creditworthiness.

Samantha Seaton, CEO of Moneyhub, comments: "For many the first step on the property ladder is the hardest. All too often, first-time buyers can struggle to prove to a lender that they have the means to pay a mortgage despite often paying higher monthly rental payments. By using open banking technology, rental payments can now be used to demonstrate creditworthiness, providing more prospective buyers with evidence that they are suitable candidates for a mortgage.

Open Data is all about putting consumers’ data back in their hands, and this is just one of the many ways that, in doing so, we can solve today’s problems. We look forward to working further with LOQBOX to use the power of open banking and Open Data to develop new and exciting features to benefit their members.”

LOQBOX members can now make use of the original LOQBOX Save feature alongside an expanded suite of features, built to give LOQBOX Lite and Full members access to the tools they need to achieve their financial goals.

LOQBOX members can expect further developments to their membership throughout 2022 as the company looks to enhance the value of LOQBOX Lite and Full memberships for anyone wanting to live a richer life.

Contacts

Ingrid Anusic

Marketing Director, Moneyhub

ingrid.anusic@moneyhub.com

M: +44 783 722 6553

About Moneyhub

Moneyhub is a global ISO 27001-certified software developer of Open Banking, Open Finance, and Open Data applications. Its FCA-regulated Open Data platform enables companies to quickly and easily transform data into personalised digital experiences and initiate payments. Its APIs and fully customisable platform provide data aggregation, insights, notification nudges, and payment systems. As a result, clients have the consent-driven data and analytics they need to create super-personalised offers, products, and services. Hundreds of organisations, spanning finance to media and retail, rely on Moneyhub’s award-winning technology.

For more details, please visit www.moneyhub.com

About LOQBOX

Most people miss out on living the life they could. That‘s wrong. And we’re here to do something about it. LOQBOX gives everyone access to a richer life. Our money app gives people the tools and support to have a better shot at being more fulfilled - personally and financially. Better off or happier? With LOQBOX, you can choose both. LOQBOX is a multi-award-winning business that has already helped almost a million people achieve a richer life by mastering their money, boosting their savings and improving their credit scores with the three main credit reference agencies. LOQBOX gives everyone a shot at a richer life.

LOQBOX is run by CEOs and Co-Founders Tom Eyre and Gregor Mowat. Tom has over a decade of experience in personal financial services. In 2012, when his little sister was refused credit to buy a sofa, frustration with the inflexibility of the financial system drove him to start creating solutions to help people improve their financial knowledge, build their savings and boost their credit history. As a former partner with global audit and advisory firm KPMG, Gregor has seen first-hand how many people around the world are unable to live their best financial lives due to a lack of tools and support, making him determined to do something about it. Both Tom and Gregor are regularly involved in conversations with commentators, governments and regulators. They have been featured in national, trade and local press and provide expert comments on finance, credit and lending.

About Experian

Experian is the world‘s leading global information services company. During life’s big moments – from buying a home or a car to sending a child to college to growing a business by connecting with new customers – we empower consumers and our clients to manage their data with confidence. We help individuals take financial control and access financial services, businesses make smarter decisions and thrive, lenders lend more responsibly, and organisations prevent identity fraud and crime.

We have 20,000 people operating across 44 countries, and every day, we’re investing in new technologies, talented people, and innovation to help all our clients maximise every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index. Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.