The invasion of Ukraine has raised significant ESG questions.

Russia last week shook the world by invading Ukraine in what is the largest military operation in Europe since WW2. Following the build-up of troops on Ukrainian borders and warnings from many Western military experts, Putin finally embarked on what he calls a ‘special military operation’ with the goal of ‘demilitarisation’ and ‘de-nazification’ of Ukraine. The invasion of Ukraine has raised significant ESG questions in regards to the future of renewable energy dependency, the human rights considerations of the invasion and governance downgrades of Russia and Belarus. Below are key ESG considerations as a result of the conflict.

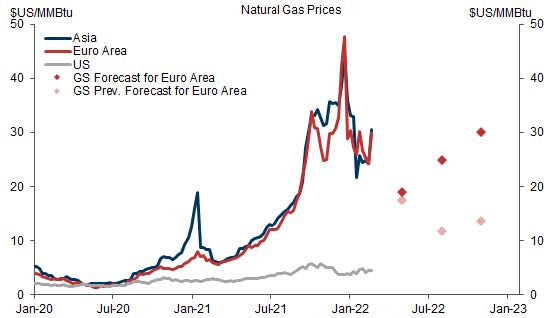

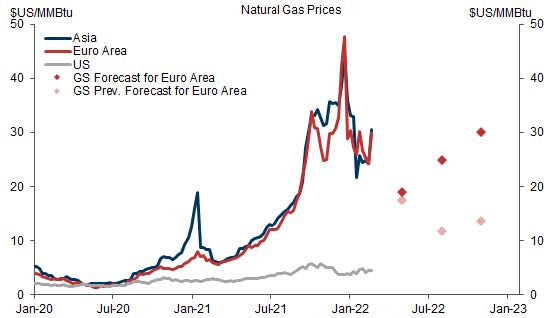

Ukraine-Russia Conflict has Created a Spike in Price of Natural Gas3

‘E’ Considerations: Surging Energy Prices and Transition to Renewables

Price of Oil and Natural Gas and European Oil Dependency:

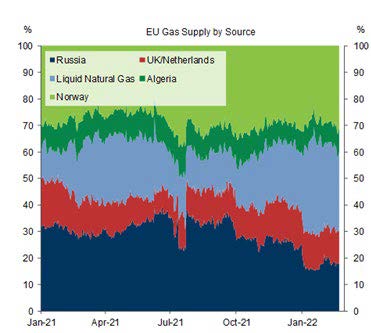

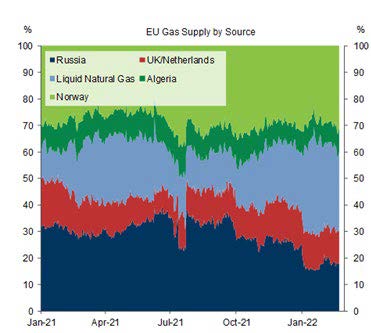

• Soaring natural gas and oil prices The full-scale military invasion of Ukraine saw European natural gas prices soaring almost 70% and crude oil exceeding the $105 a barrel mark for the first time since 2014, upending global energy supplies.1 • European energy exposure to Russian conflict is high Russia supplies about one-third of European natural gas consumption, mainly used for winter heating as well as electricity generation and industrial production.2 • Geopolitical risk of European energy supply may be the most significant factor towards adoption of alternative energy sources The awareness of Europe’s geopolitical exposure towards Russia, laid bare by this crisis, may be the most significant long term accelerant towards European countries investing in alternative energy sources. Oil majors are putting Russia at arm’s length, with BP divesting from their 20% stake in Russian state-owned oil company Rosneft and Shell exiting all of their Russian operations, including a major LNG plant in which they hold a 28% stake.2 • Potential impacts of the rising price of gas include a focus on energy efficiency Additionally, in the short term, the rise in price of oil and natural gas may result in a greater emphasis on overall commercial and residential building energy efficiency, as the cost of electricity increases, as well as faster adoption of electric vehicles as consumers seek to reduce their transportation costs. • Potential additional impacts include a short to intermediate increase in price of plastics and feedstock Increasing crude oil prices can potentially drive up petrochemical costs as well as market prices for many downstream chemical intermediates and plastics.

Potential Impacts on the Future of Coal and Nuclear Power4:

• German dependence on Russian energy partially due to reduction in nuclear power Germany’s reliance on Russia stems partly from their decision on nuclear energy, with tumultuous public and political opinion and the 2011 Japan earthquake and Fukushima nuclear disaster driving the German government to officially phase out all nuclear plants by 2022. • Coal on the short term rise Germany has signaled that they might re-consider plans to phase out coal-fired power plants by 2030 in order to shore up near-term energy requirements. Italy is taking a similar route, with Mario Draghi committing to re-open select coal-fired power stations to ensure energy demands are met in the near future. • Short term increase in carbon emissions In the short term, Europe’s dependency on Russian oil and natural gas may result in higher carbon emissions as countries return to coal fired power plants.

Impact on Renewables:

• The energy crisis expedited the timeline to transition to renewables German politicians are hoping to rush through a new act to ensure that they can fulfil all of their electricity needs from renewable sources by 2035, with the aim of increasing offshore wind production and maintaining solar panel subsidies.5 • Renewables are a key component of the path to energy independence The war in Europe adds to the urgency of transitioning to clean energy sources such as solar and wind power that are harder for climate laggards like Russia to disrupt, while also securing energy independence.5 • Short term increase for renewables Further strengthening the argument for the green energy build out, shares of renewable energy companies have been on a strong run with European giants like Ørsted, Vestas, and Siemens Gamesa seeing an uptick in share prices since the outset of the war. The European Renewable Energy Index surged as much as 9.3% on Thursday, the biggest jump since the pandemic lows of March 2020, posing a stark contrast to the European market’s collapse.6 • Long road ahead Despite the short term increase in renewable energy share prices, the European transition will take time to transition. Germany’s revised plan increased onshore wind energy to 10 gigawatts by 2027 and solar power to 20 gigawatts by 2028. The development of renewable capacity will take years to build.

European Dependency on Oil has Caused Reconsideration of Energy Sources7

‘S’ and ‘G’ Considerations: Human Rights and Governance Downgrades

• MSCI downgrades Russia and removes from EM Index In response to the Russian invasion of Ukraine, MSCI ESG Research downgraded both Russia and Belarus, as of March 1, 2022. On March 2nd, MSCI announced that it will be reclassifying Russia from an Emerging Market to a Standalone Market, which will result in the country being removed from the widely followed MSCI Emerging Markets (EM) Index.8 • Russia downgraded for Social and Governance concerns Russia’s was downgraded from BBB to B and then to CCC, given their weak scores in the categories under “Political Governance”: ‘Stability and Peace,’ ‘Political Rights and Civil Liberties’ and ‘Governance Effectiveness’ with a Negative outlook. The additional downgrade was made based on the widening domestic impact of sanctions and financial isolation on the Russian economy. The “Economic Environment” and “Financial Governance” scores were also adjusted to zero in line with the “Political Governance” score.8 • Belarus downgraded for Governance concerns Belarus’s score was also downgraded, but from a BB to a B, with a Negative outlook. Just last year, Belarus was put on Sovereign watch for their political governance goal, as a result of elevated risks presented by the Russian pressure on the government. 8 • Further assessments underway MSCI initiated ‘Very Severe’ Sovereign Watch assessments for Russia’s ‘Economic Environment’ and ‘Financial Governance’ categories of the Social and Governance pillars, respectively, reducing those scores to reflect the potentially wide-reaching domestic impact of international sanctions and financial isolation on Russia’s economy. Ukraine’s score, however, has been stable at BB with a Negative outlook. 8

Asset Owner Considerations for ESG Investing

• The Russian invasion of Ukraine has brought to light ESG considerations for asset owners in the topic of sovereign debt and global equity holdings. This geopolitical event brings up an ethical and moral issue that has financial impact and is directly tied to ESG investments, with asset owners considering where the consideration should be drawn for investments. Asset owner responses to the crisis have evolved as global government responses have rapidly shifted. Select examples show the variation in response from the asset owner community: 9

- BP Plc, for example, has owned a stake in Rosneft PJSC for about a decade, unmoved by investors' concerns about the Russian energy explorer's environmental track record. This week, however, the U.K. government pressured BP to sell the holding because of the unacceptable social ramifications tied to Russia's invasion of Ukraine.9

- In Norway, the head of the country’s $1.3 trillion sovereign wealth fund said he had no intention of selling Russian assets worth roughly $3 billion — until the government said the “brutal war of aggression against Ukraine from Russia” demanded the holding be frozen and divested. 9

- Dutch pension funds are relatively insulated from this Russian financial turmoil since they have dramatically reduced their investments in the country in recent years due to ESG considerations. ABP, BpfBouw, PME and PMT placed Russian bonds on their exclusion lists in December 2020 following the imposition of an EU arms embargo against the country.10

1 Guardian, as of February 24, 2022 2 Reuters, as of February, 28 2022 3 GIR, as of February 24, 2022 4 Reuters, as of January, 27 2022 5 Reuters, as of January, 27 2022 6 Bloomberg, as of February 24, 2022 7 GIR, as of February 24, 2022 8 MSCI ESG Research: Russia and Belarus MSCI ESG Government Ratings downgraded, as of February/March 2022 9 Bloomberg, as of March 2, 2022 10 IPE, as of February 24, 2022

Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities.

DISCLOSURES

Glossary and Risk Considerations The S&P 500 Index is the Standard & Poor’s 500 Composite Stock Prices Index of 500 stocks, an unmanaged index of common stock prices. The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 18 countries of the European region. The MSCI Emerging Markets (EM) Index is a free float-adjusted market capitalization index that captures large and mid-cap representation across five EM countries in Latin America Equity securities are more volatile than fixed income securities and subject to greater risks. Small and mid-sized company stocks involve greater risks than those customarily associated with larger companies. The above are not an exhaustive list of potential risks. There may be additional risks that should be considered before any investment decision. Any reference to a specific company or security does not constitute a recommendation to buy, sell, hold or directly invest in the company or its securities. It should not be assumed that investment decisions made in the future will be profitable or will equal the performance of the securities discussed in this document. General Disclosures MSCI ESG Rating: Each fund or ETF scores a rating on a scale from CCC (laggard) to AAA (leader). The rating is based first on the weighted average score of the holdings of the fund or ETF. MSCI then assesses ESG momentum to gain insight into the fund’s ESG track record, which is designed to indicate a fund’s exposure to holdings with a positive rating trend or worsening trend year over year. Finally, MSCI reviews the ESG tail risk to understand the fund’s exposure to holdings with worst-of-class ESG Ratings of B and CCC. MSCI leverages their ESG ratings and research coverage of over 7,500 companies (13,000 total issuers including subsidiaries) and more than 650,000 equity and fixed income securities to create ESG Ratings, scores and metrics for approximately 34,000 multi-asset class Mutual Funds and ETFs globally. To be included in Fund Ratings, a fund must pass the following three criteria: 1) 65% of the fund’s gross weight must come from covered securities, 2) Fund holdings date must be less than one year old, and 3) Fund must have at least ten securities. Please note that metrics are sourced from third party data providers as opposed to our proprietary ESG analysis. MSCI Rating Descriptions: AAA/AA (Leader) - The companies that the fund invests in show strong and/or improving management of financially relevant environmental, social and governance issues. These companies may be more resilient to disruptions arising from ESG events. A, BBB, BB (Average) - The fund invests in companies that show average management of ESG issues, or in a mix of companies with both above average and below average ESG risk management. B, CCC (Laggard) - The fund is exposed to companies that do not demonstrate adequate management of the ESG risks that they face, or show worsening management of these issues. These companies may be more vulnerable to disruptions arising from ESG events. Certain information ©2021 MSCI ESG Research LLC. Reproduced by permission; no further distribution. Although GS Asset Management’s information providers, including without limitation, MSCI ESG Research LLC and its affiliates (the “ESG Parties”), obtain information (the “Information”) from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for, or a component of, any financial instruments or products or indices. Further, none of the Information can in and of itself be used to determine which securities to buy or sell or when to buy or sell them. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. Indices are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, as applicable, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices. The indices referenced herein have been selected because they are well known, easily recognized by investors, and reflect those indices that the Investment Manager believes, in part based on industry practice, provide a suitable benchmark against which to evaluate the investment or broader market described herein. Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur. This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes. Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this document and are subject to ESG IMPLICATIONS OF RUSSIA-UKRAINE CONFLICT FOR INSTITUTIONAL OR FINANCIAL INTERMEDIARY USE ONLY – NOT FOR USE AND/OR DISTRIBUTION TO THE GENERAL PUBLIC Goldman Sachs Asset Management 4 change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance.

Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change.

The opinions expressed in this paper are those of the authors, and not necessarily of Goldman Sachs Asset Management. The investments and returns discussed in this paper do not represent any Goldman Sachs product. This paper makes no implied or express recommendations concerning how a client's account should be managed and is not intended to be used as a general guide to investing or as a source of any specific investment recommendations.

The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. Past performance does not guarantee future results, which may vary. Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources. Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security. Views and opinions are current as of the date of this document and may be subject to change, they should not be construed as investment advice. This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches ("GSBE"). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank. FOR INSTITUTIONAL OR FINANCIAL INTERMEDIARY USE ONLY – NOT FOR USE AND/OR DISTRIBUTION TO THE GENERAL PUBLIC Confidentiality No part of this material may, without Goldman Sachs Asset Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient. Goldman Sachs & Co. LLC. © 2022 Goldman Sachs. All rights reserved. 271363-OTU-1571882