Commentary - Monthly Insolvency Statistics March 2021

Published 15 April 2021

Released

15 April 2021

Next release

18 May 2021

Media enquiries

Steven Fifer

+44 (0)30 3003 1568

Statistical enquiries

Becca Wedge-Roberts (author)

Kate Palmer (responsible statistician)

1. Main Messages for England and Wales

The number of registered company insolvencies in March 2021 was 992:

- 20% lower than the number registered in the same month in the previous year (1,236 in March 2020), and

- 37% lower than the number registered two years previously (1,586 in March 2019).

For individual insolvencies, the number of bankruptcies in March 2021 was 1,028, while the number of Debt Relief Orders (DROs) was 1,591. Both were 31% lower than in March 2020 and 34% lower than in March 2019.

There were, on average, 6,388 IVAs registered per month in the three-month period ending March 2021:

- 24% higher than for the three-month period ending March 2020, and

- 2% higher than the three-months ending March 2019. Note that this series is volatile (see the Data Sources and Methodology section for more information).

Overall numbers of company and individual insolvencies have remained low since the start of the first UK lockdown in March 2020, when compared with pre-pandemic levels. This is likely to be partly driven by government measures put in place in response to the coronavirus (COVID 19) pandemic, including:

- Temporary restrictions on the use of statutory demands and certain winding-up petitions (leading to company compulsory liquidations).

- Enhanced government financial support for companies and individuals.

As the Insolvency Service does not record whether an insolvency is directly related to the coronavirus pandemic, it is not possible to state the direct effect of the pandemic on insolvency volumes.

2. Things you need to know about this release

This monthly series supplements the Insolvency Service’s quarterly company and individual insolvency National Statistics to provide more up to date information, as the coronavirus (COVID 19) pandemic continues, on the numbers of companies and individuals who are unable to pay debts and enter a formal insolvency procedure.

These statistics present monthly numbers of individual and company insolvencies in England & Wales and Northern Ireland. For Scotland, only monthly company insolvency statistics are presented; monthly individual insolvency statistics for Scotland can be found on the Accountant in Bankruptcy (AIB) website.

All figures presented within this release are provisional and subject to review. Further detail can be found in the accompanying Monthly Statistics Methodology and Quality document. Historical data presented within this statistical release may not be consistent with the previously published quarterly company and individual insolvency National Statistics.

On 26 June 2020, the Corporate Insolvency and Governance Act 2020 came into force, introducing measures to relieve the burden on businesses during the coronavirus pandemic. These measures include a moratorium to give companies breathing space from their creditors while they seek a rescue, and a new Companies Act procedure, known as a restructuring plan, that allows companies to restructure unmanageable debt. These statistics provide the number of companies that have obtained a moratorium or have had a restructuring plan following the introduction of these measures.

2.1 These statistics are designated as ‘Experimental Statistics’

These statistics are marked ‘experimental’ since the methodology and content are reviewed regularly to ensure that they continue to meet user need at this time of economic uncertainty.

As defined in the Code of Practice for Official Statistics, ‘experimental statistics’ are undergoing evaluation and are published to involve users and stakeholders in their development. The statistical production team welcomes feedback from users of these statistics. If you would like to provide feedback, then please email us at statistics@insolvency.gov.uk.

2.2 Interpretation of these statistics

Please note that some caution needs to be applied when interpreting these statistics. Notably:

- The continuing coronavirus pandemic may have affected the timeliness of insolvency registration.

- The underlying monthly data have not been seasonally adjusted and therefore comparisons are made with the same month in the previous two years rather than with the previous month.

- Due to the volatility of the underlying data on registered individual voluntary arrangements (IVAs), three-month rolling averages have also been presented to smooth out the data. However, neither counts nor three-month rolling-averages are reliable enough to indicate short-term IVA trends.

- This statistical release presents the numbers of creditors’ voluntary liquidations (CVLs), administrations, company voluntary arrangements (CVAs) and receivership appointments based on their registration date at Companies House, and therefore reflect company insolvency registrations rather than insolvency procedure start dates.

3. Company and Individual Insolvencies in England and Wales

The first UK lockdown started on 23 March 2020. Therefore, in this release comparisons are made to both March 2020, part of which coincided with the lockdown, and March 2019 which was before the start of the coronavirus (COVID 19) pandemic.

3.1 Company Insolvencies

This statistical release presents the numbers of CVLs, administrations, CVAs and receivership appointments based on their registration date at Companies House, and therefore reflect company insolvency registrations rather than insolvency procedure start dates. Compulsory liquidation data are sourced by the Insolvency Service and provide an accurate measure of the number of new cases in each month. Data for the latest month were extracted from a live system three working days after month end and therefore figures are provisional.

Overall, the numbers of registered company insolvencies have remained low since the start of the first UK lockdown in March 2020, when compared with pre-pandemic levels..

In March 2021 there was a total of 992 registered company insolvencies, comprised of 883 CVLs, 25 compulsory liquidations, 74 administrations and 10 CVAs. There were no receivership appointments.

The overall number of registered company insolvencies in March 2021 was 20% lower than in the same month in the previous year and 37% lower than in March 2019.

In March 2021, when compared with the number of company insolvencies registered in March 2020 and March 2019:

- Compulsory liquidations were 86% lower than 2020 and 90% lower than 2019;

- CVLs were 3% lower than 2020 and 23% lower than 2019;

- CVAs were 44% lower than 2020 and 66% lower than 2019; and

- Administrations were 44% lower than 2020 and 58% lower than 2019.

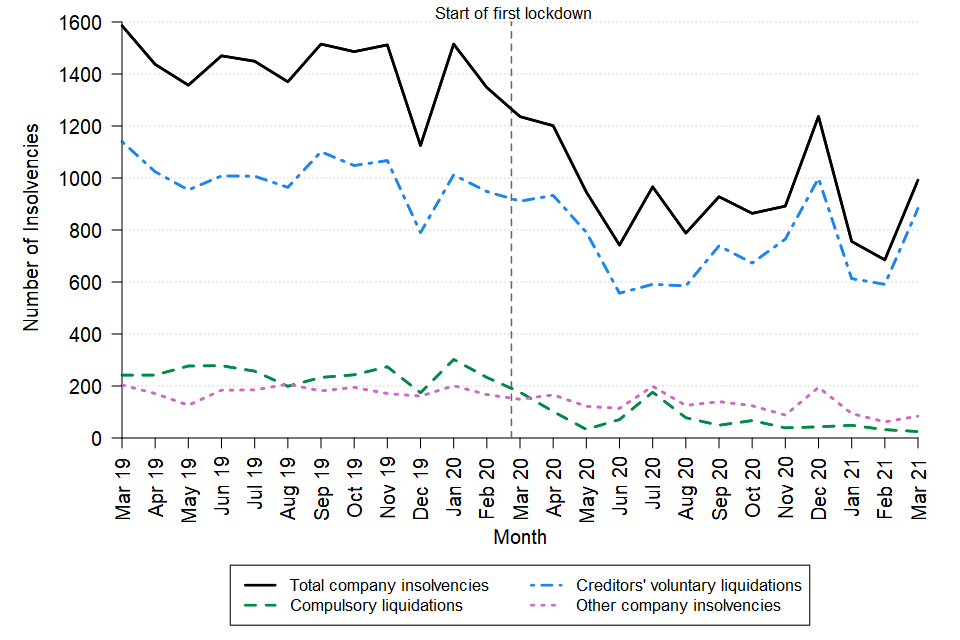

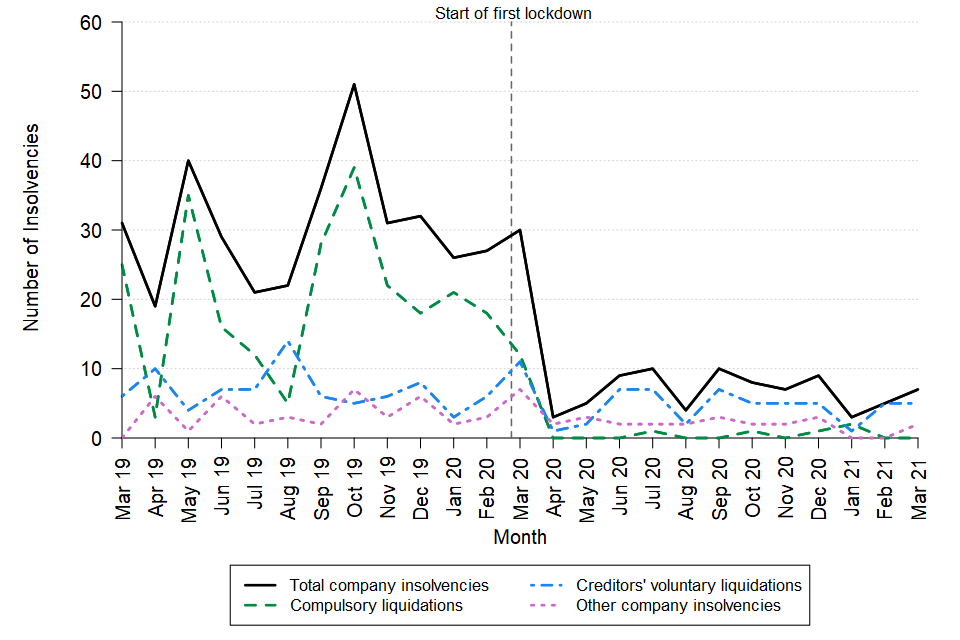

Figure 1 shows historical trend of company insolvencies covering the past 25 months. Monthly numbers back to January 2019 can be found in Table 1 of the accompanying tables.

Figure 1: Overall, numbers of registered company insolvencies have remained lower than pre-pandemic levels since the start of the first UK lockdown in March 2020

England and Wales, March 2019 to March 2021, Not seasonally adjusted

Sources: Insolvency Service (compulsory liquidations only); Companies House (all other insolvency types)

Since the start of the first UK lockdown the overall numbers of company insolvencies have remained low compared to pre-pandemic levels. The overall reduction in company insolvencies is likely to be in part driven by the range of government support put in place to financially support companies in response to the coronavirus (COVID 19) pandemic. Further details can be found on the Gov.uk website.

Between 26 June 2020 and 31 March 2021, four companies obtained a moratorium and five companies had a restructuring plan sanctioned by the court. These two new procedures were created by the Corporate Insolvency and Governance Act 2020. The low number of cases of each of these new legislative tools since the Act came into force is likely to be as a result of the range of Government support as detailed above.

Monthly company insolvency data for England & Wales can be found in the accompanying tables. Further breakdowns of company insolvencies by Standard Industrial Classification (SIC 2007) are also presented to three-digit level.

3.2 Individual Insolvencies

In this statistical release the numbers of DROs and bankruptcies are presented separately to numbers of IVAs, as IVA numbers have been calculated using different methodology. Further details are provided in the IVA results section below.

Data for the latest month were extracted from a live system three working days after month end and are subject to change. Therefore, figures are provisional.

Debt relief orders and bankruptcies

There were 1,591 DROs and 1,028 bankruptcies in March 2021 in England & Wales. The bankruptcies were made up of 937 debtor applications and 91 creditor petitions. The numbers of DROs and bankruptcies in March 2021 were both 31% lower than in March 2020 and 34% lower than in March 2019. Compared to 2020, debtor applications were 29% lower and creditor petitions were 48% lower. Compared to 2019, debtor applications were 27% lower and creditor petitions were 67% lower.

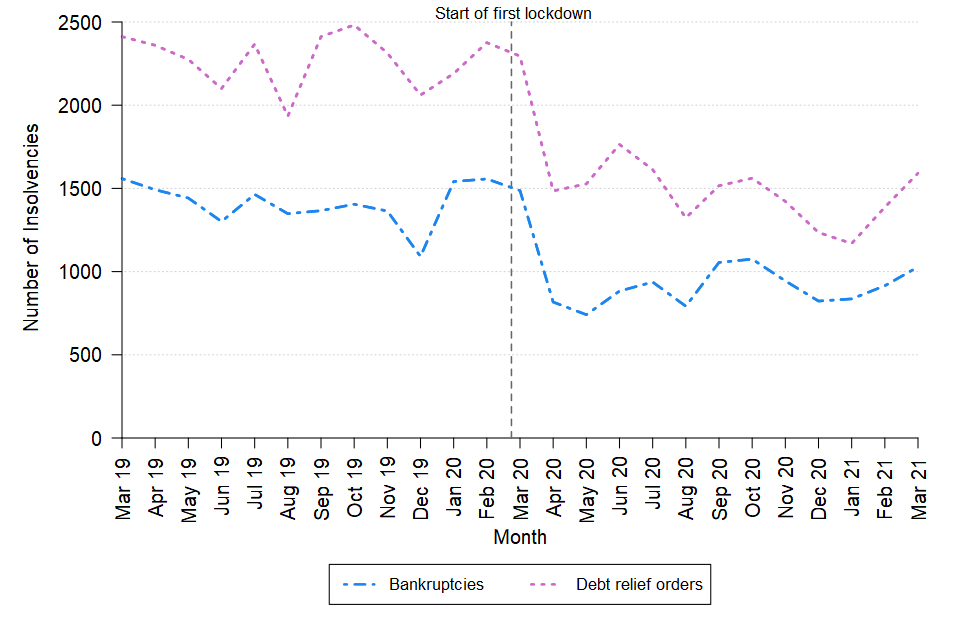

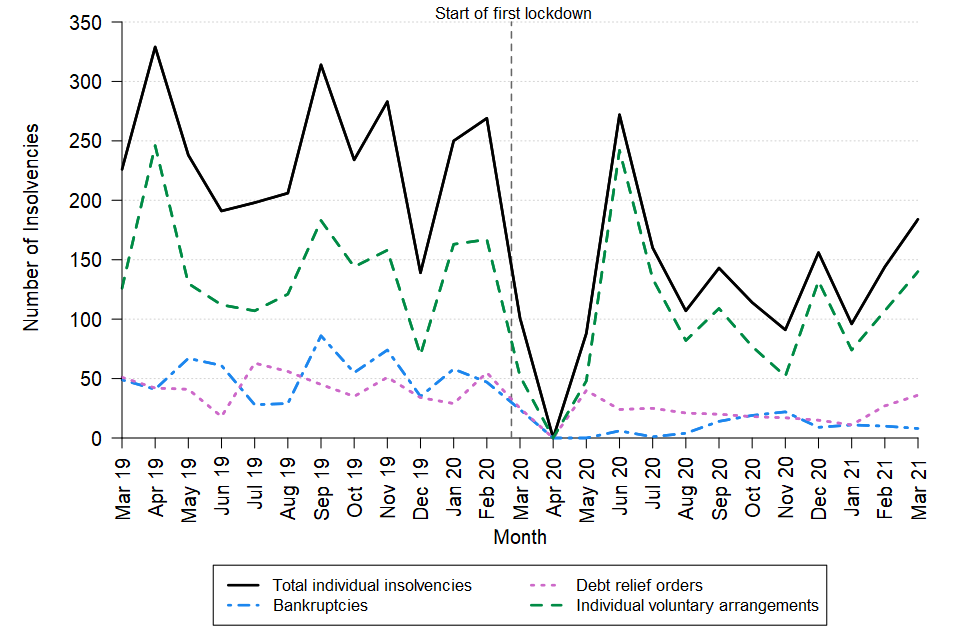

Figure 2 shows historical trend of bankruptcies and DROs covering the past 25 months. Monthly numbers back to January 2019 can be found in Table 3 of the accompanying tables.

Figure 2: Overall, numbers of individual insolvencies have remained lower than pre-pandemic levels since the start of the first UK lockdown in March 2020

England and Wales, March 2019 to March 2021, Not seasonally adjusted

Source: Insolvency Service

The lower numbers of bankruptcies arising from debtor applications, as well as DROs, correspond with a reduction in applications for these services, which coincided with the provision of enhanced government financial support for individuals and businesses since the emergence of the coronavirus pandemic.

Monthly data on DROs and bankruptcies in England & Wales can be found in the accompanying tables, including bankruptcies by employment status. Bankruptcies amongst the self-employed are also presented to the two-digit Standard Industrial Classification (SIC 2007). Due to the small numbers reported it is not feasible to present this information to a three-digit level.

Individual voluntary arrangements

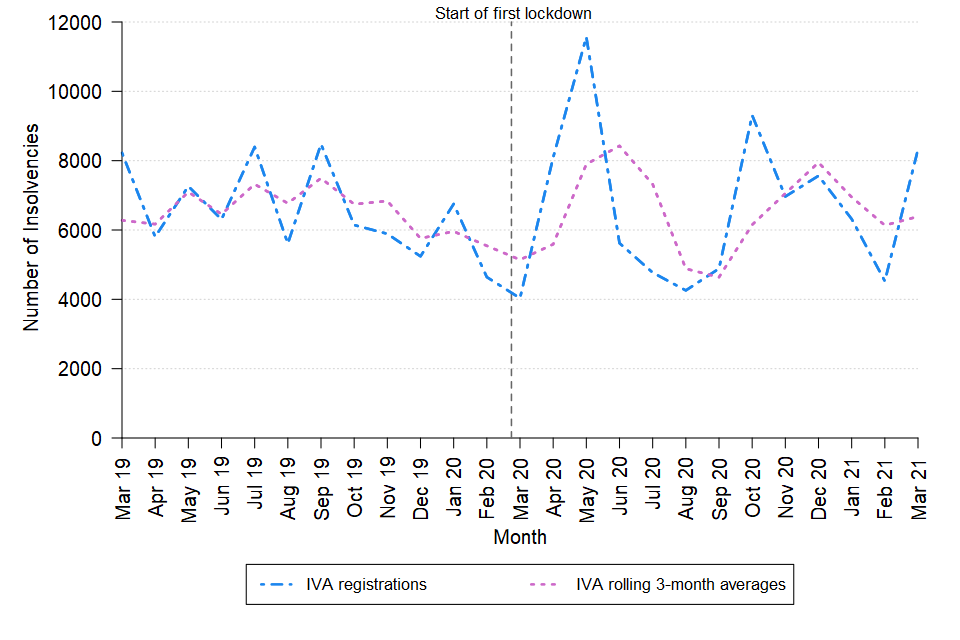

The underlying data for IVAs are volatile from one month to the next, so it is particularly important to consider longer term trends when making assessments of IVAs. Three-month rolling averages are presented to smooth the data and indicate what the overall trend of IVA registrations might look like if the underlying data were less volatile. Further information on the volatility of the IVA data, and the calculation of three-month rolling averages can be found in the accompanying Monthly Statistics Methodology and Quality document. For transparency, both counts and three-month rolling averages are presented in Figure 3 and in the accompanying tables. Whilst 3-month rolling averages are used to consider potential changes in IVA trends over time, both sets of numbers should be used with caution.

There were, on average, 6,388 IVAs registered per month in the three-month period ending March 2021, 24% higher than for the three-month period ending March 2020 and 2% higher than the three-months ending March 2019. It should be noted that one IVA provider experienced technical issues between December 2019 and March 2020 which resulted in IVAs not being registered with the Insolvency Service on a timely basis. This meant the number of IVAs registered in the three-months ending March 2020 was artificially low.

Figure 3 shows historical trend covering the past 25 months. Monthly numbers back to January 2019 can be found in Tables 4 and 4.1 of the accompanying tables. It should be noted that one IVA provider experienced technical issues between December 2019 and March 2020 which resulted in IVAs not being registered with the Insolvency Service on a timely basis. A backlog of IVAs were later registered in May 2020, resulting in an artificial ‘peak’ in that month.

Figure 3: The average number of IVAs registered per month in the three-month period ending March 2021 was similar to the three months ending March 2019, though data are volatile

England and Wales, March 2019 to March 2021, Not seasonally adjusted

Source: Insolvency Service

IVA registrations presented in Figure 3 are the numbers of registrations with the Insolvency Service in each month. The rolling 3-month averages presented are mean average number of registered IVAs in the three months ending in the reference period. For example, the three-month rolling average estimate for February 2021 is the calculated mean average of the total IVA registrations during December 2020, January 2021 and February 2021.

4. Company Insolvencies in Scotland

Legislation relating to company insolvency in Scotland is partly devolved. AIB, Scotland’s Insolvency Service, administers company liquidations and receiverships in Scotland.

This statistical release presents the numbers of CVLs, administrations, CVAs and receivership appointments based on their registration date at Companies House, and therefore reflect company insolvency registrations rather than insolvency procedure start dates.

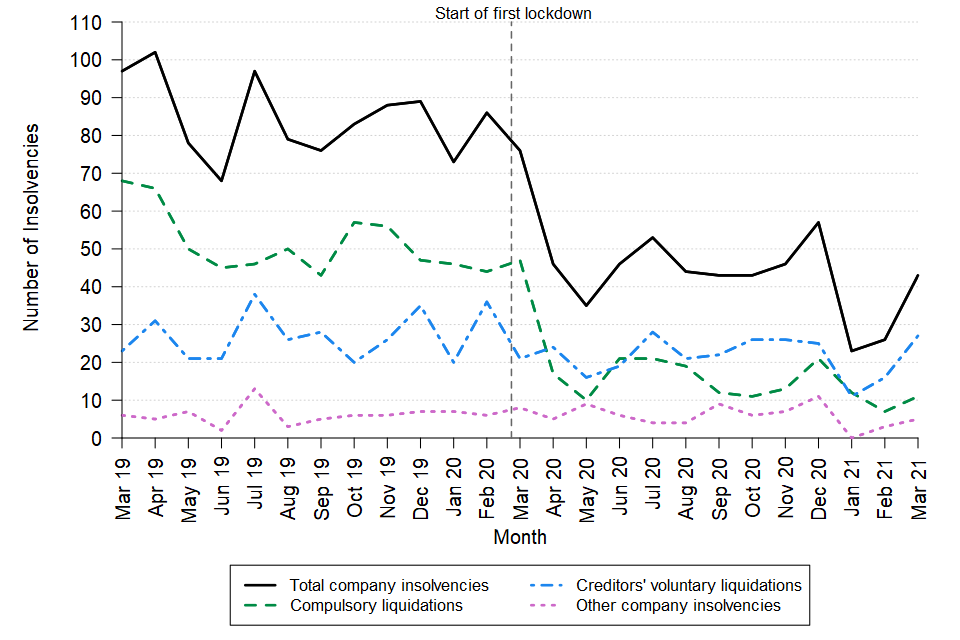

In March 2021 there were 43 company insolvencies registered in Scotland, 43% lower than in March 2020 and 56% lower than in March 2019. This was comprised of 11 compulsory liquidations, 27 CVLs, four administrations, and one CVA. There were no receivership appointments.

Historically the volume of company insolvencies registered in Scotland has been driven by compulsory liquidations. However, since April 2020 the numbers of registered CVLs have been higher than registered compulsory liquidations in 10 out of 12 subsequent months.

Figure 4 shows historical trend of company insolvencies in Scotland covering the past 25 months. Monthly numbers back to January 2019 can be found in Table 7 of the accompanying tables.

Figure 4: Overall, numbers of registered company insolvencies have remained lower than pre-pandemic levels since the start of the first UK lockdown in March 2020

Scotland, March 2019 to March 2021, Not seasonally adjusted

Source: Companies House

Monthly company insolvency data for Scotland can be found in the accompanying tables. Further breakdowns of company insolvencies by Standard Industrial Classification (SIC 2007) are also presented to two-digit level. Due to small numbers it was not feasible to present this information to three-digit level.

Note that this statistical bulletin does not present monthly individual insolvency statistics for Scotland. This information can be found on the AIB website.

5. Company and Individual Insolvencies in Northern Ireland

Company and Individual insolvency in Northern Ireland is governed by separate, but broadly similar, legislation to England & Wales. Figures are presented separately.

5.1 Company Insolvencies

This statistical release presents the numbers of CVLs, administrations, CVAs and receivership appointments based on their registration date at Companies House, and therefore reflect company insolvency registrations rather than insolvency procedure start dates.

In March 2021 there were seven company insolvencies registered in Northern Ireland, 77% lower than in both March 2020 and March 2019. This comprised of five CVLs, one administration and one CVA. There were no compulsory liquidations, or receivership appointments.

Figure 5 shows historical trend of company insolvencies in Northern Ireland covering the past 25 months. Monthly numbers back to January 2019 can be found in Table 9 of the accompanying tables.

Figure 5: Overall, numbers of registered company insolvencies have remained lower than pre-pandemic levels since the start of the first UK lockdown in March 2020

Northern Ireland, March 2019 to March 2021, Not seasonally adjusted

Sources: Companies House and Department for the Economy

5.2 Individual Insolvencies

In March 2021 there were 184 individual insolvencies in Northern Ireland, 82% higher than March 2020 but 19% lower than March 2019; this consisted of 140 IVAs, 36 DROs and 8 bankruptcies.

Figure 6: Overall, numbers of individual insolvencies have remained low since the start of the first UK lockdown in March 2020

Northern Ireland, March 2019 to March 2021, Not seasonally adjusted

Figure 6 shows historical trend of individual insolvencies in Northern Ireland covering the past 25 months. Monthly numbers back to January 2019 can be found in Table 10 of the accompanying tables. It should be noted that there were no new individual insolvencies in Northern Ireland in April 2020 as a result of the Lockdown measures being implemented by the Northern Ireland Executive which resulted in the closure of the Courts and Insolvency Service offices in the region.

Source: Department for the Economy

Monthly company and individual data for Northern Ireland can be found in the accompanying tables.

6. Data and Methodology

6.1 Data Sources

Company insolvency data for England & Wales, Scotland and Northern Ireland are sourced from Companies House, except for compulsory liquidation data for England & Wales and Northern Ireland. Compulsory liquidation data for England & Wales are sourced from the Insolvency Service case information system (ISCIS). Compulsory liquidation data for Northern Ireland are sourced from the Department for the Economy, Northern Ireland.

Individual insolvency data for England & Wales are sourced from ISCIS; individual insolvency data for Northern Ireland are sourced from the Department for the Economy.

Moratorium and Restructuring Plan data are sourced from Companies House. More information on the administrative systems used to compile insolvency statistics can be found in the Statement of Administrative Sources.

6.2 Coverage

This statistical release presents company insolvencies for England & Wales, Scotland and Northern Ireland. Individual insolvencies are presented for England & Wales, and Northern Ireland only. Individual insolvency statistics for Scotland can be found on the AIB website. Insolvency statistics for Scotland and Northern Ireland are presented separately to statistics for England & Wales since they are covered by separate legislation and policy responsibility lies with the devolved administrations.

6.3 Methodology and data quality

Detailed methodology and quality information for the monthly insolvency statistical releases can be found in the accompanying Monthly Statistics Methodology and Quality document.

The main quality and coverage issues to note:

- This statistical release presents the numbers of CVLs, administrations, CVAs and receivership appointments based on their registration date at Companies House, therefore reflecting company insolvency registrations rather than insolvency procedure start dates.

- There is known seasonality in the underlying data for most insolvency types. Any seasonality is normally adjusted before compiling insolvency statistics. However, these monthly data have not been seasonally adjusted so month-on-month comparisons may not be valid.

- Data for the latest month were extracted three working days after month end. Since the administration systems are live systems there is an increased likelihood that figures will be revised in the future. Therefore, all figures in this release are provisional.

- The sum of these monthly statistics may not equal previously published quarterly statistics, due to differing methodologies. In addition, the administrative systems used to capture data are live systems and are subject to amendments.

- These statistics may not align with information published separately by Companies House, or with data extracted from the Gazette. Further information on why numbers may not align can be found in the accompanying Monthly Statistics Methodology and Quality document.

Data quality issues affecting underlying data on individual voluntary arrangements

Individual voluntary arrangements (IVAs) are counted within these statistics once they are registered with the Insolvency Service, and they are reported by month of registration date. There is often a time lag between the date on which the IVA is accepted (known as the date of creditor agreement) and date of registration by licensed insolvency practitioners working for firms that specialise in this area, and changes in trends are often partly a result of how promptly and frequently providers register IVAs with the Insolvency Service. Therefore, these monthly statistics are considerably more volatile than the quarterly data published within the Quarterly Individual Insolvencies series, and comparisons of monthly numbers are unreliable.

In order to continue to provide timely, yet less volatile, information on IVAs, three-month rolling averages were calculated to smooth out the underlying data and present the overall direction of monthly trends. However, these statistics should still be interpreted with caution. See Methodology section of the accompanying Monthly Statistics Methodology and Quality document for further detail.

Aggregate counts of moratoriums and restructuring plans were compiled for the whole period covering 26 June 2020 to 31 March 2021.

6.4 Revisions

These statistics are subject to scheduled revisions, as set out in the published Revisions Policy. Other revisions tend to be made as a result of data being entered onto administrative systems after the cut-off date for data being extracted to produce the statistics. There is an increased likelihood that published statistics for the most recent month will be revised in the future, because the data were only extracted approximately three working days after month end. Any future revisions will be marked with an ‘r’ in the relevant table.

These statistics are designated ‘experimental’ since the methodology and processing of the monthly data are routinely reviewed to ensure that these statistics are meeting user need.

7. Glossary

7.1 Key Terms used within this statistical bulletin

| Administration | The objective of administration is the rescue of the company as a going concern, or if this is not possible then to obtain a better result for creditors than would be likely if the company were to be wound up. A licensed insolvency practitioner, ‘the administrator’, is appointed to manage a company’s affairs, business and property for the benefit of the creditors. |

|---|---|

| Bankruptcy | A form of debt relief available for anyone who is unable to pay their debts. Assets owned will vest in a trustee in bankruptcy, who will sell them and distribute the proceeds to creditors. Discharge from debts usually takes place 12 months after the bankruptcy order is granted. Bankruptcies result from either Debtor application – where the individual is unable to pay their debts, and applies online to make themselves bankrupt, or Creditor petition – if a creditor is owed £5,000 or more, they can apply to the court to make an individual bankrupt. These statistics relate to petitions where a court order was made as a result, although not all petitions to court result in a bankruptcy order. |

| Company Voluntary Arrangement (CVA) | CVAs are another mechanism for business rescue. They are a voluntary means of repaying creditors some or all of what they are owed. Once approved by 75% or more of creditors, the arrangement is binding on all creditors. CVAs are supervised by licensed insolvency practitioners. |

| Compulsory liquidation | A winding-up order obtained from the court by a creditor, shareholder or director. See Liquidation for details on the process. |

| Creditors’ Voluntary Liquidation (CVL) | Shareholders of a company can themselves pass a resolution that the company be wound up voluntarily. See Liquidation for details on the process. Administrations which result in a Creditors’ Voluntary Liquidation are recorded separately by Companies House and are excluded from CVL figures as they do not represent a new company entering into an insolvency procedure for the first time. These cases are only ever recorded as Administrations. |

| Debt Relief Order (DRO) | A form of debt relief available to those who have a low income, low assets and less than £20,000 of debt. There is no distribution to creditors, and discharge from debts takes place 12 months after the DRO is granted. |

| Deed of Arrangement | An alternative way for a debtor to deal with their affairs than entering into bankruptcy or an individual voluntary arrangement. Deeds of arrangement require the approval of a simple majority of creditors in number and value, and do not require a nominee, report to court or a meeting of creditors to be held. |

| Individual Voluntary Arrangement (IVA) | A voluntary means of repaying creditors some or all of what they are owed. Once approved by 75% or more of creditors, the arrangement is binding on all. IVAs are supervised by licensed Insolvency Practitioners. |

| Liquidation | Liquidation is a legal process in which a liquidator is appointed to ‘wind up’ the affairs of a limited company. The purpose of liquidation is to sell the company’s assets and distribute the proceeds to its creditors. At the end of the process, the company is dissolved – it ceases to exist. Statistics on compulsory liquidations and creditors’ voluntary liquidations are presented in these statistics. A third type of winding up, members’ voluntary liquidation is not included because it does not involve insolvency. |

| Moratorium | Moratoriums were introduced under the Corporate Insolvency and Governance Act 2020 to give struggling businesses formal breathing space in which to explore rescue and restructuring options, free from creditor or other legal action. Except in certain circumstances, no insolvency proceedings can be instigated against the company during the moratorium period. It also prevents legal action being taken against a company without permission from the court. |

| Partnership Winding-up Order | This is similar to the liquidation of a company. When the partners have decided that the partnership has no viable future or purpose then a decision may be made to cease trading and wind up the partnership. There are two basic ways that the partnership can be wound up: the creditors petition and a partner’s petition. |

| Receivership Appointment | Administrative receivership is where a creditor with a floating charge (often a bank) appoints a licensed insolvency practitioner to recover the money it is owed. Before 2000, receivership appointments also included other, non-insolvency, procedures, for example under the Law of Property Act 1925. |

| Restructuring Plan | New restructuring measures were introduced under the Corporate Insolvency and Governance Act 2020 to support viable companies struggling with unmanageable debt obligations to restructure under a new procedure. They allow the court to sanction a plan that binds creditors to a restructuring plan if it is fair and equitable. Creditors vote on the plan, but the court can impose it on dissenting classes of creditors (‘cram down’) provided that the necessary conditions are met. |

| Standard Industrial Classification (SIC 2007) | Used in classifying business establishments and other statistical units by the type of economic activity in which they are engaged. Further information can be found on the ONS website. |