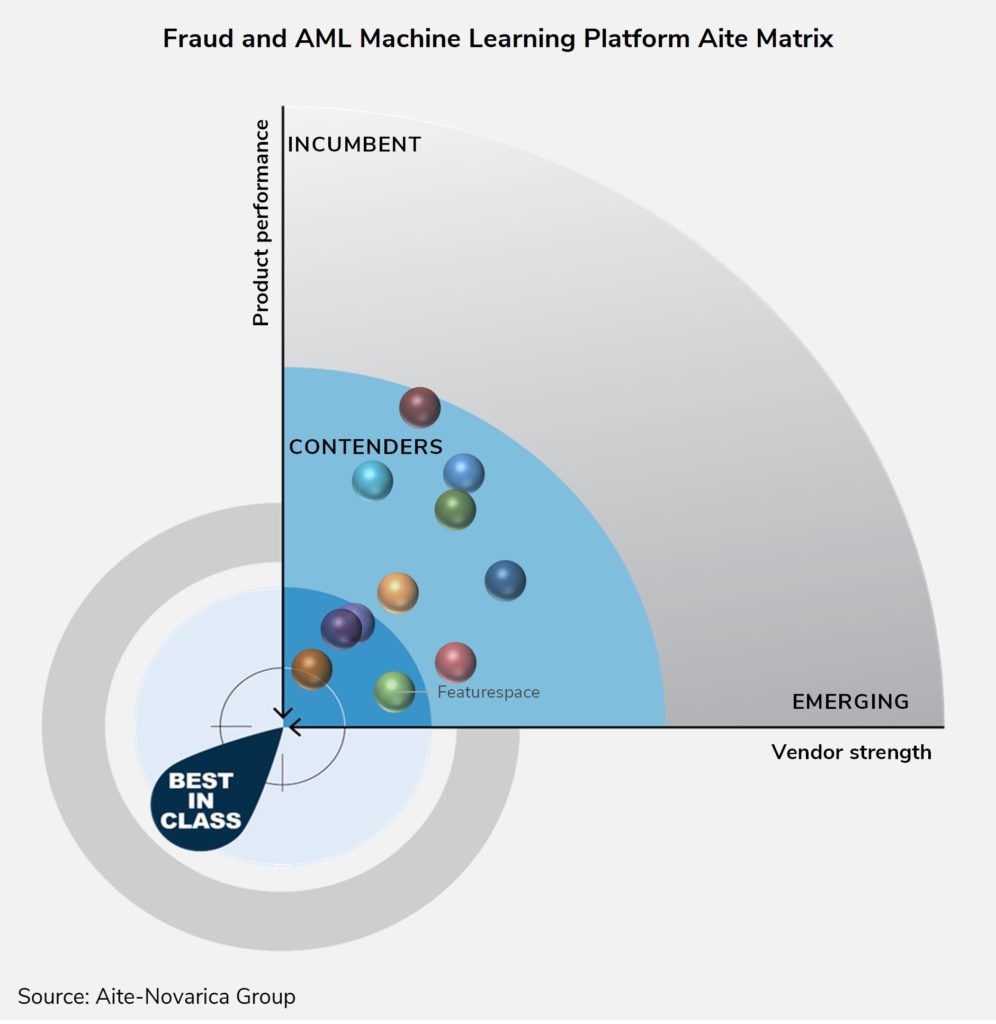

Featurespace™, the leading provider of Enterprise Financial Crime Prevention software, and its ARIC™ Risk Hub, have been named Best in Class and the top performing vendor for product performance by Aite-Novarica Group, a leading advisory firm providing critical insights and advice to financial institutions. Download a free excerpt of Featurespace’s inclusion in Aite-Novarica Group’s AIM Evaluation: Fraud and AML Machine Learning Platform Vendors report below.

- Customers praise ARIC™ Risk Hub’s application of advanced analytics and high-performing models

- Customers laud ARIC Risk Hub’s model explainability, transparency, essential for governance and regulatory requirements

- Featurespace’s payment fraud detection solution named product performance leader

The competitive research conducted by Aite-Novarica Group assessed four specific criteria, with Featurespace excelling in each. Notable callouts include:

- ARIC™ Risk Hub was the leader in product performance. The proprietary payment fraud detection and prevention solution monitors transactions and predicts behavior in real time, enabling banks to evaluate and mitigate risk.

- Featurespace’s customers said the company’s models outperform peers in the market and have continued adapting to the evolving threat landscape, especially during the pandemic.

- ARIC™ Risk Hub delivers market leading functionality for customer model authoring.

- Featurespace’s knowledge of data science, its forward-thinking approach and professionalism were also noted.

One client remarked that ‘Few machine learning vendors open the black box, and no provider does it as well as the folks at Featurespace. They provided more explainability and transparency than any other platforms on the market.’

This follows the company’s recognition for market leading AML innovation and client service as part of Aite-Novarica Group’s 2021 Fraud & AML Impact Innovation Awards, as well as its previous Best-in-Class recognition in the firm’s 2019 report on Fraud and AML machine learning platform vendors.

“Aite-Novarica Group is well-regarded for providing actionable technology, strategy, and operations advice to many of the world’s top financial institutions,” said Dave Excell, Founder of Featurespace. “We are really proud that our customers have given us such great feedback in this report, and it is a real honor for this level of expertise to be flagged as the top performer for product performance.”

As the self-learning platform is used by Featurespace’s customers and more deeply understands behaviors, it predicts risk thresholds in real time with increasing accuracy. The proven platform is used by more than 70 major global financial institutions and this year – as real time fraud and financial crime prevention becomes business critical – Featurespace has been selected by record number of new partners, including: eftpos, the Australian debit card payment system; a large Irish financial services company; a major Nigerian payments and switch services provider; and multiple banks across the U.S. and Europe.

From Aite-Novarica Group: “As the cost of fraud and money laundering continue to climb, Featurespace’s platform is elevating banks’ proactive monitoring and prevention measures which in turn help reduce business risk and cost. The goal of our research is to help institutions make better decisions, and none are more important than those that protect customers from fraud.”

Enter your email for the full report, and the latest insight on fraud and AML

Download the ReportShare